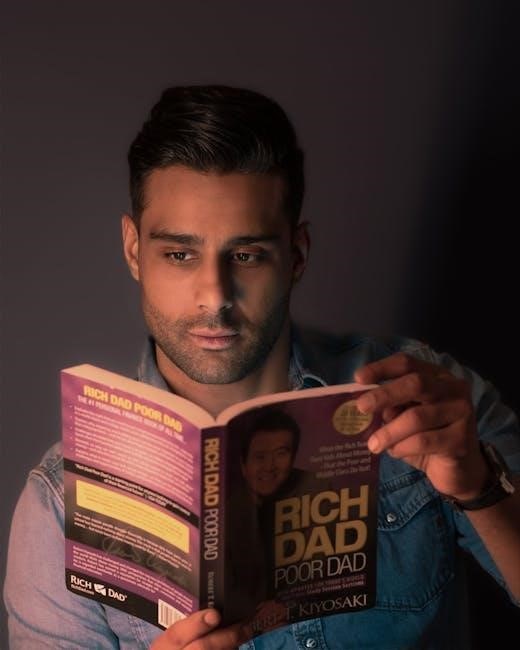

rich dad poor dad:pdf

Written by Robert T. Kiyosaki and Sharon Lechter‚ Rich Dad Poor Dad explores contrasting financial philosophies through the author’s two father figures.

Overview of the Book and Its Author

Rich Dad Poor Dad‚ authored by Robert T. Kiyosaki and Sharon Lechter‚ is a groundbreaking personal finance book first published in 1997. It narrates Kiyosaki’s upbringing with two father figures: his educated but financially struggling “poor dad” and his friend’s father‚ a wealthy entrepreneur known as “rich dad.” The book contrasts their financial philosophies‚ emphasizing the importance of financial literacy‚ investing‚ and building assets over traditional employment. Kiyosaki’s unorthodox approach challenges conventional wisdom about money‚ advocating for entrepreneurship and passive income. The book has become a global phenomenon‚ inspiring millions to rethink their financial strategies and pursue wealth-building opportunities. Its practical advice and real-life insights continue to influence readers worldwide.

The core of Rich Dad Poor Dad lies in the stark contrast between the financial mindsets of the “rich dad” and the “poor dad.” The “poor dad‚” Robert’s biological father‚ believed in traditional education and job security‚ often prioritizing stability over financial independence. In contrast‚ the “rich dad‚” his friend’s father‚ championed financial literacy‚ entrepreneurship‚ and investing in assets that generate income; This dichotomy highlights the book’s central theme: understanding money and building wealth through strategic investments rather than relying solely on a paycheck. These contrasting viewpoints serve as the foundation for Kiyosaki’s teachings on achieving financial freedom and escaping the cycle of middle-class limitations.

Rich Dad Poor Dad introduces foundational financial strategies‚ emphasizing assets over liabilities and building multiple income streams to achieve financial independence and long-term wealth. Financial literacy is the cornerstone of wealth-building‚ as emphasized in Rich Dad Poor Dad. Robert Kiyosaki stresses the importance of understanding how money works‚ advocating for practical knowledge over traditional education. He argues that financial intelligence empowers individuals to make informed decisions about earning‚ saving‚ and investing. By mastering concepts like cash flow‚ taxes‚ and asset management‚ readers can break free from the cycle of living paycheck to paycheck. Kiyosaki’s philosophy encourages readers to think critically about money‚ challenging conventional wisdom and fostering a mindset focused on financial independence rather than job security. In Rich Dad Poor Dad‚ Robert Kiyosaki distinguishes between assets and liabilities‚ a concept crucial for wealth accumulation. Assets generate income‚ such as real estate‚ stocks‚ or businesses‚ while liabilities drain resources‚ like mortgages or car loans. Many mistake liabilities for assets‚ hindering financial growth. Kiyosaki advises prioritizing asset acquisition to build passive income streams‚ emphasizing that true wealth lies in owning income-producing properties. This principle challenges traditional views‚ urging readers to focus on investments that yield returns rather than accumulating debt. Understanding this difference is vital for achieving financial independence and escaping the cycle of earned income. Rich Dad advocates for financial independence through entrepreneurship and investments‚ while Poor Dad prioritizes job security and traditional education‚ highlighting contrasting approaches to money and success. Rich Dad’s philosophy emphasizes investing and entrepreneurship as the cornerstone of wealth creation. He advocates for acquiring assets that generate passive income‚ such as real estate‚ businesses‚ and stocks. Unlike traditional views‚ Rich Dad encourages people to pursue financial independence by building multiple income streams rather than relying on a single job. He believes in taking calculated risks and leveraging money to work for you‚ rather than working for money. This mindset shifts focus from earning a paycheck to creating systems that produce wealth. Rich Dad also stresses the importance of financial education‚ teaching individuals to manage money effectively and make informed investment decisions to achieve long-term prosperity. Poor Dad’s philosophy revolves around the importance of job security and traditional education. He believes in earning a steady paycheck‚ climbing the corporate ladder‚ and relying on employers for financial stability. Poor Dad emphasizes the value of hard work‚ academic achievement‚ and loyalty to a company. He views education as the key to securing a high-paying job and advancing in a career. However‚ this mindset often leads to a lifelong dependence on employment‚ limiting financial freedom. Poor Dad’s approach contrasts sharply with Rich Dad’s emphasis on entrepreneurship and investing‚ highlighting the tension between traditional employment and wealth-building strategies. His perspective reflects societal norms but offers limited pathways to true financial independence. Rich Dad Poor Dad encourages readers to build multiple income streams‚ invest in assets‚ and enhance financial intelligence to achieve financial independence and security. Robert Kiyosaki emphasizes the importance of creating multiple income streams to achieve financial freedom. He advocates for investing in assets like real estate‚ businesses‚ and stocks that generate passive income. By diversifying income sources‚ individuals can reduce reliance on a single paycheck‚ which Rich Dad views as risky. This approach encourages entrepreneurship and financial independence‚ contrasting with Poor Dad’s focus on a stable job. Kiyosaki stresses that building wealth requires proactive strategies to ensure money works continuously‚ rather than depending on a single income stream. This philosophy is central to the book’s teachings on securing long-term financial stability. Rich Dad Poor Dad underscores the importance of financial intelligence as a cornerstone of wealth creation. Robert Kiyosaki defines financial intelligence as the ability to make informed decisions about money‚ distinguishing between assets and liabilities. He advocates for continuous learning‚ such as understanding taxes‚ investing‚ and market trends‚ to enhance one’s financial IQ. This intelligence enables individuals to identify opportunities‚ manage risks‚ and build wealth systematically. Kiyosaki criticizes traditional education for lacking financial literacy‚ urging readers to take control of their financial education. By improving financial intelligence‚ people can break the cycle of living paycheck-to-paycheck and achieve long-term financial independence. This concept is central to the book’s message. Rich Dad Poor Dad has faced criticism for its perceived oversimplification of wealth-building strategies. Some argue Kiyosaki’s advice lacks practicality for average individuals‚ while others question its accuracy. Debates surround the practicality of Rich Dad Poor Dad’s advice. Critics argue that Kiyosaki’s strategies‚ such as aggressive real estate investing‚ are risky and not feasible for everyone. While some find the book motivating‚ others claim its concepts lack depth and do not address systemic financial barriers. Supporters‚ however‚ believe the book’s emphasis on financial literacy and entrepreneurship is transformative; The debate highlights the book’s polarizing impact‚ with some viewing it as a groundbreaking guide and others as overly simplistic or misleading. This divide underscores the complexity of applying its teachings universally. Some critics accuse Robert Kiyosaki of misrepresentation in Rich Dad Poor Dad. Allegations include exaggerating his success and fabricating the “Rich Dad” figure for storytelling impact. Additionally‚ claims of promoting unproven investment strategies and failing to disclose risks have led to accusations of scamming readers. While Kiyosaki denies these claims‚ the controversies highlight concerns about the book’s credibility and advice. These debates have sparked caution among readers‚ urging them to critically evaluate the content before applying its principles. The allegations have not diminished the book’s popularity but remind readers to approach its teachings with a discerning mindset. Rich Dad Poor Dad remains a widely debated yet influential guide‚ challenging traditional financial views and inspiring millions to rethink money‚ wealth‚ and financial independence. Rich Dad Poor Dad has left a significant mark on personal finance‚ challenging traditional views on money and wealth. Its emphasis on financial literacy‚ investing‚ and entrepreneurship has inspired millions to rethink their financial strategies. Critics argue some advice is oversimplified‚ but the book remains a powerful motivator for financial independence. Its influence extends beyond finance‚ encouraging readers to pursue wealth-building opportunities and question conventional wisdom about work and money. Love it or hate it‚ Rich Dad Poor Dad has undeniably shaped modern conversations about personal finance and wealth creation‚ making it a cornerstone of financial education for many.The Central Theme: Contrasting Mindsets of Rich Dad and Poor Dad

Key Financial Concepts in “Rich Dad Poor Dad”

Financial Literacy: The Foundation of Wealth Building

Assets vs. Liabilities: Understanding the Difference

Mindset and Philosophy

Rich Dad’s Philosophy: Investing and Entrepreneurship

Poor Dad’s Philosophy: Job Security and Traditional Education

Practical Applications of the Book’s Teachings

Building Multiple Income Streams

Increasing Financial Intelligence

Criticisms and Controversies

Debates Over the Book’s Practical Advice

Allegations of Misrepresentation and Scam Claims

The Lasting Impact of “Rich Dad Poor Dad”